- Recession Dopamine Nonsense

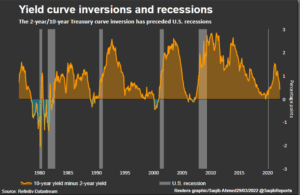

by Frederick Ravid, ChFCRecession Imminent? Nonsense! Financial media just can’t get addicted enough to thoughtless prognostications. Recession forecasts are the Click-bait eyeball catcher du jour. Let’s break this down. And while we’re at it we’ll talk about inflation, inverted yield curve as a forecast for recession, what could deliver rising equity prices, how our portfolio is doing, and… Read more: Recession Dopamine Nonsense

by Frederick Ravid, ChFCRecession Imminent? Nonsense! Financial media just can’t get addicted enough to thoughtless prognostications. Recession forecasts are the Click-bait eyeball catcher du jour. Let’s break this down. And while we’re at it we’ll talk about inflation, inverted yield curve as a forecast for recession, what could deliver rising equity prices, how our portfolio is doing, and… Read more: Recession Dopamine Nonsense - How to invest now including new Moneygrow developments

by Frederick Ravid, ChFCWith down markets and horrors in world news, what are you doing to mitigate risk and address safety, rising interest rates, and inflation? We are pleased to announce, if you have a retail account(s) at Schwab, or TD Ameritrade and realize you need professional guidance, we have added Schwab to our already existing relationship with TD Ameritrade, to expand our list of… Read more: How to invest now including new Moneygrow developments

by Frederick Ravid, ChFCWith down markets and horrors in world news, what are you doing to mitigate risk and address safety, rising interest rates, and inflation? We are pleased to announce, if you have a retail account(s) at Schwab, or TD Ameritrade and realize you need professional guidance, we have added Schwab to our already existing relationship with TD Ameritrade, to expand our list of… Read more: How to invest now including new Moneygrow developments - UPDATE Your Estate Plans

by Frederick Ravid, ChFCThis blog serves as a reminder that you need to update Estate Planning, Wills, Trusts, Powers of Attorney, and other documents and “Ultimate Plans.” Well, as we all know, we’re not getting any younger, so let’s talk about doing an UPDATE for your estate plan. Have you reviewed your Will, Trusts, Powers of Attorney, and… Read more: UPDATE Your Estate Plans

by Frederick Ravid, ChFCThis blog serves as a reminder that you need to update Estate Planning, Wills, Trusts, Powers of Attorney, and other documents and “Ultimate Plans.” Well, as we all know, we’re not getting any younger, so let’s talk about doing an UPDATE for your estate plan. Have you reviewed your Will, Trusts, Powers of Attorney, and… Read more: UPDATE Your Estate Plans - Avoid Dumb Embrace Smart

by Frederick Ravid, ChFCSmart Investment Practices, Hedging Inflation This blog contains the professional investor’s perspective about how to and how not to trade this market. What Investors Can Glean From FBI Active Shooter Training If, God-forbid you were in a location where an active shooter was randomly pursuing targets of opportunity, what is the right choice? Lay flat… Read more: Avoid Dumb Embrace Smart

by Frederick Ravid, ChFCSmart Investment Practices, Hedging Inflation This blog contains the professional investor’s perspective about how to and how not to trade this market. What Investors Can Glean From FBI Active Shooter Training If, God-forbid you were in a location where an active shooter was randomly pursuing targets of opportunity, what is the right choice? Lay flat… Read more: Avoid Dumb Embrace Smart - No Pain No Gain Ukraine

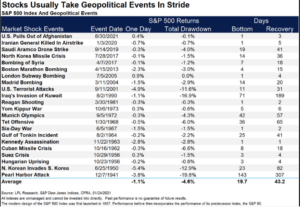

by Frederick Ravid, ChFCHistoric Geopolitical Tensions and Expectations We do not buy into the narrative that a new European war is inevitable, but this is not a moment to leave you guessing about our preparedness, and where we stand portfolio-wise. What is our strategy as the days unfold? Context matters: As you can see from the chart above, market drawdowns… Read more: No Pain No Gain Ukraine

by Frederick Ravid, ChFCHistoric Geopolitical Tensions and Expectations We do not buy into the narrative that a new European war is inevitable, but this is not a moment to leave you guessing about our preparedness, and where we stand portfolio-wise. What is our strategy as the days unfold? Context matters: As you can see from the chart above, market drawdowns… Read more: No Pain No Gain Ukraine - Feb 2022 Commentary

by Frederick Ravid, ChFCThis contains my observations about todays’ news vs my pro investor’s viewpoint. We’ll cover Inflation, Ukraine, Corporate Strength and the dramatic Meta/Facebook spanking and proposed legislation that might disrupt the ROTH IRA. Narrative Vs. Economics/Geopolitics FACTS: WIDELY Divergent! We closely follow the news cycle and the underlying Economics/Geopolitics. Today, there is a huge divergence between… Read more: Feb 2022 Commentary

by Frederick Ravid, ChFCThis contains my observations about todays’ news vs my pro investor’s viewpoint. We’ll cover Inflation, Ukraine, Corporate Strength and the dramatic Meta/Facebook spanking and proposed legislation that might disrupt the ROTH IRA. Narrative Vs. Economics/Geopolitics FACTS: WIDELY Divergent! We closely follow the news cycle and the underlying Economics/Geopolitics. Today, there is a huge divergence between… Read more: Feb 2022 Commentary - Financial Advisor or Cog in a Profit-Driven Machine?

by Frederick Ravid, ChFCYou have a “relationship” with a Financial Advisor but, who and what is actually driving this affair? This lady can’t tell the difference between a Financial Advisor and a Registered Investment Advisor. She’s ready to get help. What are Financial Advisors’ real motivations?

by Frederick Ravid, ChFCYou have a “relationship” with a Financial Advisor but, who and what is actually driving this affair? This lady can’t tell the difference between a Financial Advisor and a Registered Investment Advisor. She’s ready to get help. What are Financial Advisors’ real motivations? - Robo-Advisors are Flawed and Here’s Why It’s official. Robo-Advisors are now a thing!

by Frederick Ravid, ChFCOh, the sheer marvel of it… here’s a cut-rate automated asset management solution! What could be better than that? We suggest a human being? Seriously! Here’s why: Wall Street loves to bypass responsibility for your outcome Do you want to be an experimental lab-rat? It’s possible that’s where you’re headed if you choose a Robo-Advisor.… Read more: Robo-Advisors are Flawed and Here’s Why It’s official. Robo-Advisors are now a thing!

by Frederick Ravid, ChFCOh, the sheer marvel of it… here’s a cut-rate automated asset management solution! What could be better than that? We suggest a human being? Seriously! Here’s why: Wall Street loves to bypass responsibility for your outcome Do you want to be an experimental lab-rat? It’s possible that’s where you’re headed if you choose a Robo-Advisor.… Read more: Robo-Advisors are Flawed and Here’s Why It’s official. Robo-Advisors are now a thing! - Money Management: Are You Paying Attention?

by Frederick Ravid, ChFCMake sure your money is in the right PLACE, with the right HANDS, NOW. When it comes to Money these are the essential things to look for: Get a Fiduciary who serves your account diligently. That means frequent, understandable reviews Make certain whoever helps you routinely communicates about what actually matters to you. Get service from somebody… Read more: Money Management: Are You Paying Attention?

by Frederick Ravid, ChFCMake sure your money is in the right PLACE, with the right HANDS, NOW. When it comes to Money these are the essential things to look for: Get a Fiduciary who serves your account diligently. That means frequent, understandable reviews Make certain whoever helps you routinely communicates about what actually matters to you. Get service from somebody… Read more: Money Management: Are You Paying Attention? - When 169 Million USA Shareholders Wake Up

by Frederick Ravid, ChFCWhere is the real power in the USA? Where is the real power in the USA? Over 169 million shareholders¹ in the United States are the sleeping giant of power. The time has come for the giant to awaken according to former Securities and Exchange Commission Chairman and author Arthur Levitt. “As a group, the… Read more: When 169 Million USA Shareholders Wake Up

by Frederick Ravid, ChFCWhere is the real power in the USA? Where is the real power in the USA? Over 169 million shareholders¹ in the United States are the sleeping giant of power. The time has come for the giant to awaken according to former Securities and Exchange Commission Chairman and author Arthur Levitt. “As a group, the… Read more: When 169 Million USA Shareholders Wake Up - When Your Mom and Dad Have Money

by Frederick Ravid, ChFCYour parents should be treated like people not numbers. Cookie Cutter solutions are abundant. If your parents are dealing with a retail brokerage like a bank or major investment company, they probably don’t realize that their “Financial Advisor” is either marching in step with the whole office “or else.” That’s because the management philosophy of… Read more: When Your Mom and Dad Have Money

by Frederick Ravid, ChFCYour parents should be treated like people not numbers. Cookie Cutter solutions are abundant. If your parents are dealing with a retail brokerage like a bank or major investment company, they probably don’t realize that their “Financial Advisor” is either marching in step with the whole office “or else.” That’s because the management philosophy of… Read more: When Your Mom and Dad Have Money - Year-End Notifications

by Frederick Ravid, ChFCMarket Performance Optimism We remain optimistic about market performance and do not find justification for bearish sentiment that appeared under the fear-inciting Omicron news cycle. Portfolio Rebalances Master portfolio holdings have already been adjusted to meet our intended allocations for 1q 2022. We believe this “pre-emptive” approach to rebalancing will yield greater advantages for our… Read more: Year-End Notifications

by Frederick Ravid, ChFCMarket Performance Optimism We remain optimistic about market performance and do not find justification for bearish sentiment that appeared under the fear-inciting Omicron news cycle. Portfolio Rebalances Master portfolio holdings have already been adjusted to meet our intended allocations for 1q 2022. We believe this “pre-emptive” approach to rebalancing will yield greater advantages for our… Read more: Year-End Notifications - 4Q 2021 Market Update

by Frederick Ravid, ChFCMarkets reached a high at 3rd week of September, then we saw a inflation anxiety drawdown lasting about 1 month that flattened S&P quarterly return to a mere 0.58% while those clients fully participating in the CFS Master Portfolio exceeded 3% return for the third quarter. The economy remains robust. Behind this progress we note that in… Read more: 4Q 2021 Market Update

by Frederick Ravid, ChFCMarkets reached a high at 3rd week of September, then we saw a inflation anxiety drawdown lasting about 1 month that flattened S&P quarterly return to a mere 0.58% while those clients fully participating in the CFS Master Portfolio exceeded 3% return for the third quarter. The economy remains robust. Behind this progress we note that in… Read more: 4Q 2021 Market Update