Smart Investment Practices, Hedging Inflation

This blog contains the professional investor’s perspective about how to and how not to trade this market.

What Investors Can Glean From

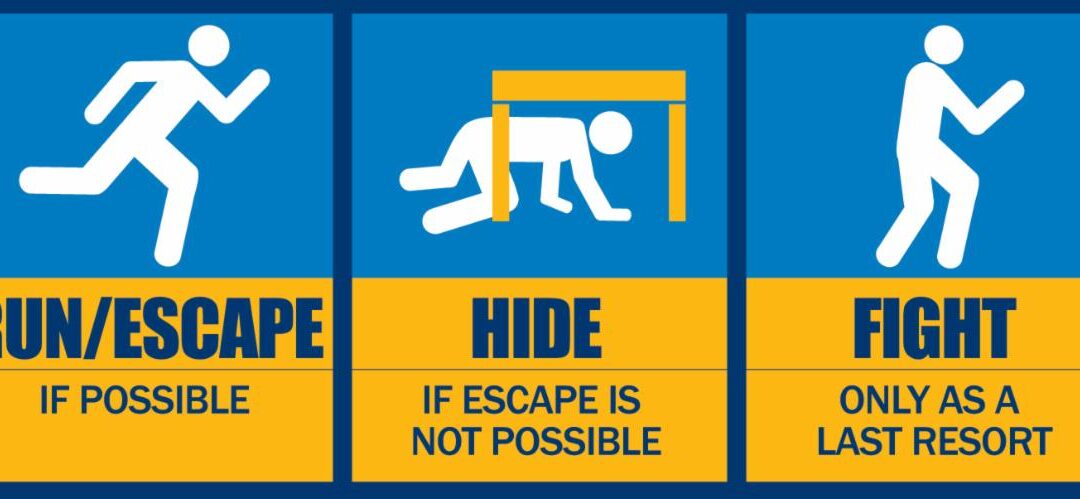

FBI Active Shooter Training

If, God-forbid you were in a location where an active shooter was randomly pursuing targets of opportunity, what is the right choice? Lay flat and play dead? Confront the Shooter? Get the Hell Out of range if possible?

I recently attended a FBI training in which many video scenarios involving active shooters were shown. Laying down and playing dead is a common response, but this was cited as among the WORST possible choices. Targeted victims of the Las Vegas mass shooting hunkered down instead of running for their lives. If they would have removed themselves from the rifle-scope field of vision they would have saved their lives.

As investors, do any of these responses make any sense NOW? What about “selling out” during a downward trending market? Real world historical evidence demonstrates that selling in a downward trending market isn’t the wise choice for the long run, because rebounds happen and if you are out, then you are “down and out.” Yet, emotions can get hold of you and this is what some people do, to their financial disadvantage.

AVOID Binary Thinking

Our Basic Trading Rules

- Avoid Placing Trades on Fridays. Why? Because in this volatile world, the weekend can bring a sea change in sentiment and you’re likely better off waiting till the following week.

- Only buy positions that show resilience in comparison to other choices. Buying investments out of phase with investor support can be compared to arriving late at a party. If the cars are pulling away from the house, it’s not time for you to go in. You’ll find a punch bowl mostly drained with cigarette butts floating inside.

- Never sell on a “down” market day. Why? You’re mostly guaranteed to get a lower settlement price for what you’ve just sold.

- Be aware that mass thinking is often wrong. Day-today market prices are often emotionally driven. Just because markets PRICES are trending down AT THE MOMENT does not constitute a declining ECONOMIC trend.

- Avoid buying beleaguered securities because “it HAS to go up.” Buying quality doesn’t mean buying yesterday’s prime candidates which have wilted and are showing mold and mildew.

- Always embrace the economic trend. During the pandemic, investing in online and cloud were great examples of following the trend. Today’s hot spot is INFLATION HEDGING.

Hedge Against Inflation

The inside Wall Street story today is how market wizards are making a killing hedging against inflation. It’s complex, to a “don’t try this at home” level. But, as you look at rising prices of commodities and their trade patterns, you can see there is quite bit of opportunity. NO, we’re not going to give you a list of the prime commodities we recommend but we will state that a properly prepared basket of essential commodities that are trading with suitable attention to the dynamcs of supply and demand is alive and well in our portfolio. We’ve holding a long position in commodities that has outpaced inflation and in the YTD range of over 11%. And in the past year, this position has risen by over 27%. Will this advantage continue to be helpful to our clients’ portfolios, come rain or shine? We expect so.

Excellent post. I was checking continuously this

weblog and I am impressed! Extremely useful information specially the remaining part 🙂 I care for such info much.

I used to be seeking this particular information for a long time.

Thanks and good luck.