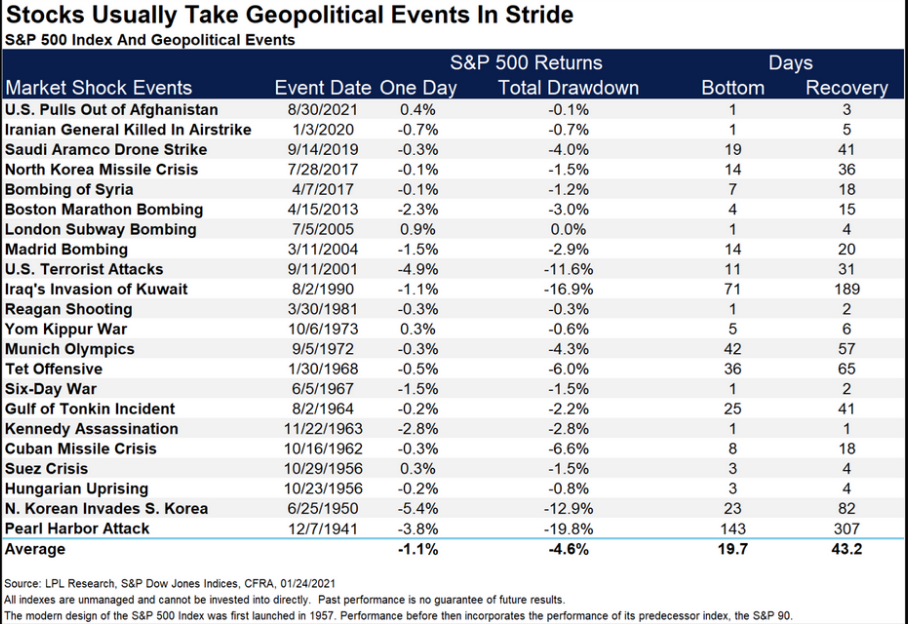

Historic Geopolitical Tensions and Expectations

We do not buy into the narrative that a new European war is inevitable, but this is not a moment to leave you guessing about our preparedness, and where we stand portfolio-wise. What is our strategy as the days unfold? Context matters: As you can see from the chart above, market drawdowns in the aftermath of major geopolitical events tend to witness recovery within a matter of weeks. This may come as a surprise to those who are feeling anxious, anticipating financial horrors. Even after the 9-11 attacks, the market recovered in a month’s time. This information should give you some needed comfort. But after such a long upward run in market performance the shock of market corrections is understandable.

Despite this potentially comforting data, our portfolio management approach is not “sitting idly by” without careful consideration of risk and opportunity given the several unfolding event-horizon fronts moving through at the moment. These include inflation, geopolitics, and interest rate responses to all of the above.

Current Portfolio Strategy

Any drawdown is uncomfortable, and the reduction in market valuations so far this year have been unsettling. Our objective to avoid reductions in value that exceed 8%. To avoid risk, in our Master Portfolio, we have raised cash and reduced exposure to certain portfolio components that are showing weakness and made adjustments.

Why not “Go To Cash? Then, What?

Should the Ukraine situation blow over, world market prices are likely to rebound. It’s unwise to presume that our human efforts to capitalize on such a rebound would be so deft as to advantageously capture such a market rebound. Holding 100% cash can be very risky. This is because most market moves are abrupt, and they happen in a matter of days, and are unpredictable. Our approach is that we would only go to 100% cash under the most dire of circumstances. Had we gone to cash in the midst of the January market correction our portfolio would have suffered amidst the rebound.

If Russia invades, the “Risk Off” attitude to the stock market we’ve seen develop thus far in 2022 will come to greater focus, but investors will wisely pile on to proven leadership and drive discounted leader’s prices upwards, raising index values. IF invasion happens it’s likely that the FED will NOT be as aggressive in raising rates.

Potential Invasion Scenario

What might an invasion timetable look like?

Think “after the Feb 20 Olympic Closing Ceremonies on Feb 20.” Why? This way, Putin doesn’t take away from his pseudo-friend Xi Jinping’s 15minutes of fame. (Never imagine Putin actually has any “Friends.”)

So, THIS is How We’re Preparing

Whether or not the Russians invade Ukraine, we expect a buying opportunity will arise despite other headwinds.

- We’ve trimmed our portfolio back to a lower equity percentage allocation and now hold a higher level of cash.

- We’ve added exposure to a critical Economic Sector because it’s unimaginable that this sector not continue to rise and thus, profits will attend.

- We need to patiently continue our watchfulness and pursue advantages and avoid risk wherever they might be found.