Chartered Financial Services, Inc.™ is a fee-based Registered Investment Advisor providing investment management and strategic financial guidance to individuals, businesses, and the public.

MoneyGrow®

A Different Kind of Investment Relationship

Built on Experience, Clarity, and Active Partnership

- Make clear, well-reasoned plans you truly understand.

- Own investments that reflect your values and are built to endure.

- Gain confidence and control through attentive, fiduciary guidance.

- Direct capital toward health, stability, and long-term prosperity.

- Avoid exposure to industries that profit from harm and instability.

A Perspective Shaped by Experience

After nearly 9,500 trading days in this field, I have seen countless investment strategies come and go. Many appeared compelling at first, but over time I learned where they fell short and what truly creates lasting value.

As my experience deepened, so did my understanding of the industry itself. Too often, the focus is placed solely on making individuals wealthy, without equal consideration for the broader impact of those decisions. Financial success matters, but it should not be the only measure guiding how we invest.

I believe our money reflects our values. How we choose to deploy it shapes our communities and the world our children and grandchildren will inherit. This perspective is not political. It is rooted in responsibility, decency, and a belief that capital can support outcomes that strengthen rather than harm.

This is the lens through which I work with every client, helping align financial decisions with both long-term goals and a more sustainable future.

–Frederick Ravid, ChFC®

The Real Risk Is Doing Nothing

Procrastination and lack of clear information are two of the most common threats to long-term financial security. They rarely come from carelessness. More often, they come from uncertainty, competing demands, or not knowing where to begin.

At Moneygrow, we help replace hesitation with clarity.

Guidance That Fits Real Life

Your financial life is more than a portfolio. It evolves through work, family, opportunity, and transition. Our role is to provide strategic guidance that supports your goals, protects your future, and helps you make informed decisions with confidence.

During your accumulation years, that may include:

- Tax-aware planning

- Business and career decisions

- Philanthropy and charitable strategy

- Trust and estate considerations

- Major life or liquidity events

Later in life, the focus shifts toward:

- Thoughtful legacy and multigenerational planning

- Sustainable income and distribution planning

- Preserving flexibility and independence

An Active Partnership Makes the Difference

The greatest financial risks often go unnoticed. Inattention and procrastination take hold when life gets busy or financial decisions feel overwhelming. Generic reassurance from large institutions can reinforce passivity, leaving important details unaddressed.

Engaged clients make better decisions. They stay aligned with their goals and avoid costly oversights.

Our structured client review process, supported by the 24/7/365 Moneygrow® Client Portal, is designed to keep you informed, involved, and moving forward with purpose.

Ready to Take the Next Step?

If you’re wondering whether our approach aligns with your goals and values, the best place to start is a conversation.

Schedule a Complimentary Conversation

Why Moneygrow® Is Different

We believe that your investments should reflect the pride you have in your life, your values, and the legacy you’re building. They should not contribute to the very issues you hope the world will overcome.

Too often, capital flows toward activities that fuel conflict, harm communities, or degrade the environment. Headlines make this clear. But you have the power to redirect your money toward a more constructive path.

Most people are overwhelmed, distracted, and rarely fully engaged in their financial lives. Large financial institutions often reinforce this passivity. You deserve better, and you are capable of better. That shared belief forms the foundation of our work together, and it’s why our guiding principle is: Invest in Life.

The Moneygrow® Technical Advantage:

You deserve complete, effortless access to the information that supports your financial life. The Moneygrow® Client Portal is built on robust, modern technology that keeps every detail clear, organized, and up to date with just a click.

Behind the scenes, our advanced internal systems support thoughtful investment selection, diligent oversight, and responsive account management. Your trading and account resources are maintained with industry-leading security and quality standards, ensuring that your financial information is protected and your experience is seamless.

Our goal is simple: to give you the clarity, confidence, and transparency you need to stay fully informed and fully in control.

Not yet a client?

Request a Demo to gain access to your own Client Portal and the Moneygrow® advisory services.

Spectrum of MoneyGrow® Services:

Where We Go From Here?

The time has come for the financial world – including regulators, institutions, media, educators, executives, and stakeholders – to embrace a more responsible vision of what investing truly means.

- Investment should serve more than the pursuit of profit. It should support the creation of a stable and balanced world.

- We have a responsibility to reorient the way we think about financial decisions – both individually and collectively.

- Expanding our focus beyond short-term gains is essential if we want to prevent the consequences of an imbalanced system.

- When we broaden our understanding of investment to include long-term well-being, resilience, and fairness, we address the root causes of the instability that affects us all.

- A better future is possible, and together we can help shape it.

Our Commitment:

We are here to restore a sense of justice and accountability to the way your money is put to work. Your investments should strengthen your life, your values, and the world you want to see.

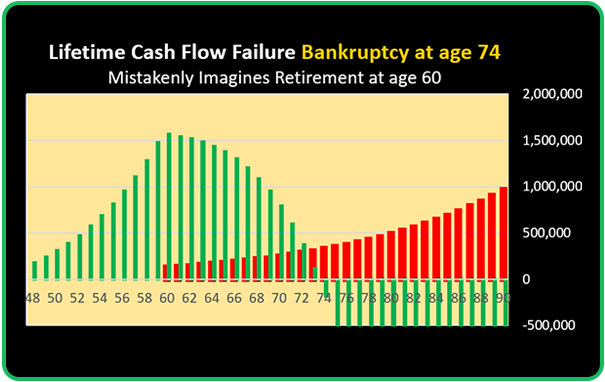

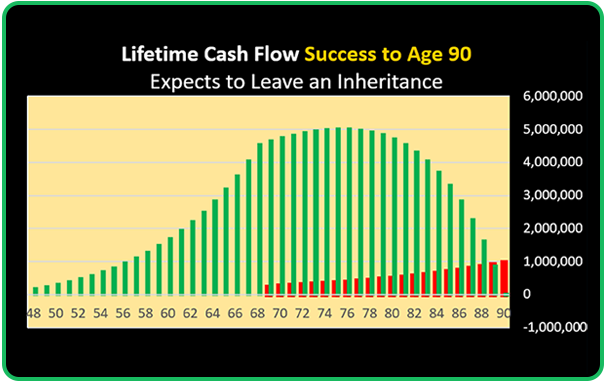

In Financial Planning the key question is:

“Will your money outlast your life expectancy?”

Which scenario is yours?

Ask us to perform Your Lifetime Cash Flow Study

We can consider all your financial factors and deliver clear answers. We can help you avoid Financial Surprises. Planning Ahead is the Right Approach.

“Quarterback” Advisor vs “One-Stop Shop”

How we build your advisory team

Our “Pro Quarterback” approach selects from among Attorneys, Accountants, and other respected experts in your locale, including people you already know and trust. To bring your plans to fruition, we often find that this approach is superior than one-stop shops whose in-house personnel are typically less-experienced. One-stop shop might sound attractive but often it’s a marketing gimmic. “Pro Quarterback” assures that all advisors are on the same page and likely more cost-effective over the long run.

Our Distinctions

Leaders in Responsible Investment

- Investors’ money has real power to create positive impact. Impact is only optimized when investments are properly directed. Bad headlines stem from misdirected investment.

- Your Investments can and should make a positive impact. Your portfolio holdings should be honorable and demonstrate your commitment to a better societal outcome.

Our Advantages vs. Brokerage Firms

- Brokerage Firms are sales organizations with many conflicts of interest.

- Unlike Financial Advisors, and the vast majority of CFP® Financial Planners, we are legally required to put your interested ahead of our own.

- We never charge commissions or offer any “financial products” for sale.

- We provide clients with credentialed personal advice across the spectrum of life’s opportunities

- We accountable, responsive, and personal. You are never “a number” to us.

Keeping you informed

- Useful and understandable reviews each and every quarter

- Robust client portal with 24/7/365 access

- Frequent newsletters

- 24-hour turnaround policy, to answer questions and help you meet your needs.