Markets reached a high at 3rd week of September, then we saw a inflation anxiety drawdown lasting about 1 month that flattened S&P quarterly return to a mere 0.58% while those clients fully participating in the CFS Master Portfolio exceeded 3% return for the third quarter. The economy remains robust. Behind this progress we note that in the third quarter, S&P reported the third highest quarterly profit margin since 2008. Three of the eleven Economic Sectors of the S&P500 have reported significant advantages, those being Real Estate (34.4%), Info Tech (24.1%), and Financials (18.6%). Six of the Sectors trailed these sectors significantly.

The narrative today expresses concerns about COVID, SUPPLY CHAIN, FEDERAL RESERVE TAPERING, and STOCK MARKET PERFORMANCE.

COVID is most harmful for the vulnerable Senior over-65 age group. 76% of COVID deaths have occurred in this cohort. Close to 90% of the Senior population is fully immunized, leaving about 2 million unvaccinated highly-vulnerable citizens, representing only 2% of the US population. This means from the market perspective, COVID is not a serious economic risk factor.

SUPPLY CHAIN for most items is matter of delivery rather than a matter of manufacture. Delivery delay is associated to bottlenecks at major ports. It is considered to be a temporary problem, not a long-term problem. During this period in which supply chain has been constrained, huge numbers of companies are reporting positive earnings surprises, not earnings deficits. Meanwhile this phenomenon yields price increases for the first time in a long deflationary period. Forecasts suggest price increases will not affect demand and lead to higher top-line profitability for cyclical companies.

FEDERAL RESERVE TAPERING involves cessation of bond-buying by the FED. Tapering will likely begin in the last month of 2021 and bond-buying is likely to end in June-July of 2022, leading to first rate hikes around 4Q 2022. The current schedule does not lead to the conclusion that the US economy will be constrained in the near term by this slow rate hike scenario. In fact, rate hikes do not represent declines in market performance. During the last series of FED rate hikes starting in 2015 after the 2008 recession, the market ROSE nearly 50%.

STOCK MARKET PERFORMANCE is expected to be favorable. Gross Domestic Product (GDP) growth for the next 12 months is expected to be about 5%, compared to a 30-year average of about 2.5%. high GDP growth generally equates to higher profits and strong markets. S&P forecast for 2022 is for 10% earning growth against a historical backdrop of 7-8%. Meanwhile savings are at high levels, while credit card balances are comparably low. Hence, the economic statistics suggest this is a good environment for Stock investment.

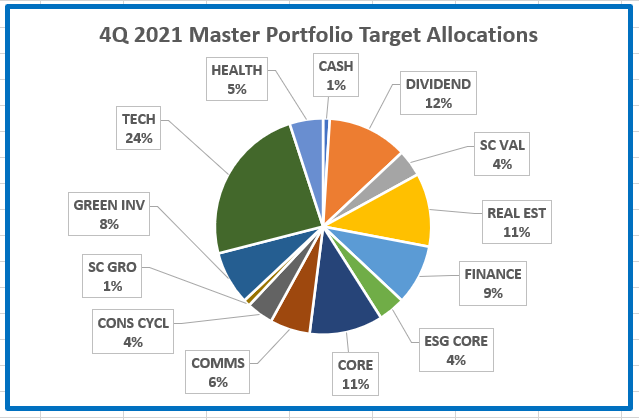

4Q 2021 Master Portfolio Rebalance

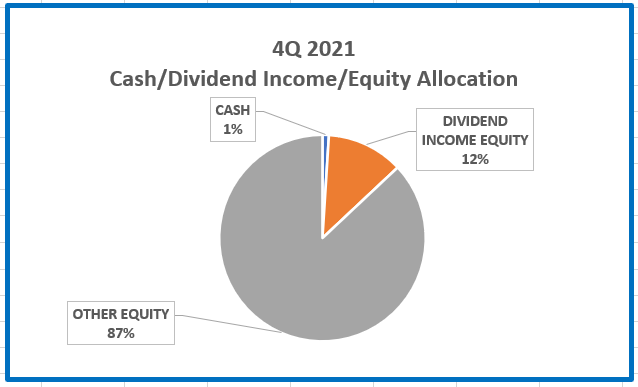

Each major rebalance involves fine-tuning our allocations to favorable economic sectors and stocks. However, in this rebalance. we have made a significant change to our customary allocation in cash alternatives vs holding extremely low yield money markets. We have eliminated US Treasury Securities, Short Maturity Bonds and Senior Floating-Rate Bank Loan paper due to rising effective interest rates. We replaced these with a portfolio of highly screened consistently-rising-dividend-paying stocks via an exchange-traded portfolio of 50 securities that does NOT include energy and utility companies who are polluters we seek to avoid.

4q 2021 Sector Allocations

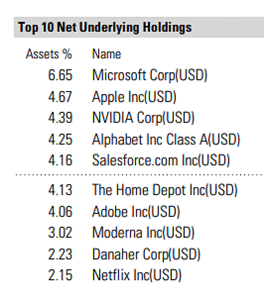

Our Top 10 Holdings

Are YOU up to date with our new client portal?

Download the myAdvisorLink app.

Chartered Financial Services, Inc. CEO Frederick Ravid has committed considerable time and resources

to upgrading your client experience in this past quarter. The Advyzon Client Portal is now open, and

the important question is are YOU using it?

Use the App on your smart device or visit advyzon.com to enjoy the upgrade.

ALL CLIENTS: Send us an email and confirm you are in the portal, able to see your investments and in particular, pay attention to your VAULT where we are in actively posting your REVIEWS and INVOICES.