You have a “relationship” with a Financial Advisor but, who and what is actually driving this affair?

This lady can’t tell the difference between a Financial Advisor and a Registered Investment Advisor. She’s ready to get help.

What are Financial Advisors’ real motivations?

A Financial Advisor or a Registered Investment Advisor?

Financial Advisors are nothing more than salespeople working for broker-dealers. Thus, a red flag should be noted, since Financial Advisors earn commissions on their sales. Many brokerage firms sell in-house products which typically pay their Financial Advisors higher commissions or special incentives. As as result, in-house products often involve intrinsic conflicts of interest. Additionally, some financial products simply pay better commissions than others. Compensation differences may bias a Financial Advisor’s attention towards higher-paying “recommendations.”

Financial Advisor – an Undefined Role

There is no strict definition of a Financial Advisor other than having passed certain exams. These exams license the Financial Advisor to speak with the public about investments. The licensee falls under the supervision of a Broker-Dealer. Thus, your Financial Advisor is operating as an agent within a system driven by the pursuit of revenue, aka sales. Finance is a culture of numbers, and within the industry, Financial Advisors are evaluated on their “production.” If the Financial Advisor’s production numbers are high, they might be given the title of Senior Vice President. This happens in large bank/retail brokerage firms with over 15,000 Financial Advisors. Financial Advisors who have low production are often shown the door.

Supervision and Compliance matter

A Branch Manager, or “Registered Principal” exerts high levels of control over the Financial Advisor’s business activities. You will probably never meet this person. The Principal might even be in a different city. Principals have two functions: Sales Management and Compliance. Sales Management establishes sales performance quotas, product training, and maybe marketing support. The Compliance role controls what the Financial Advisor can say and do. The Principal is responsible for compliance with a huge number of regulations. The Financial Industry National Regulatory Authority (FINRA), maintains and enforces these regulations. They oversee 650,000+ Financial Advisors, which makes the Brokerage Firm culture a very “top-down” environment. Financial Advisors have to toe-the-line established by the Principal. Only certain types of advice or recommendations are supported and other approaches may be ignored.

NOT in Your Best Interest?

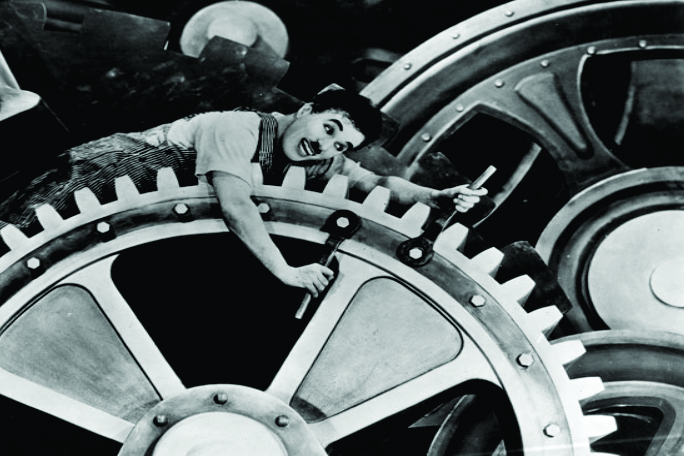

It doesn’t take a detective to see that in today’s financial marketplace, the product selection, communication and other factors under the firm’s control are set up to be as efficient and profitable as possible. No rules exist to ensure that each and every element of your financial relationship has to be in your best interest unless you deal with a Registered Investment Advisor. Google the “complaints” for any major financial brokerage firm to see what happens when your Financial Advisor is merely a cog in a faceless machine.

In Your Best Interest!

Registered Investment Advisors are required, by statute, to function as Fiduciaries. In 2016, a major bank that shall go unnamed filed a letter with the Secretary of the Securities and Exchange Commission about the new Department of Labor Fiduciary Rule. They said this rule should be “limited in scope,” stating explicitly that the rule should not affect any other types of accounts, including regular investment accounts, credit operations or other bank activities. In other words, “screw the customer.” You can probably guess the name of that bank.