With down markets and horrors in world news, what are you doing to mitigate risk and address safety, rising interest rates, and inflation? We are pleased to announce, if you have a retail account(s) at Schwab, or TD Ameritrade and realize you need professional guidance, we have added Schwab to our already existing relationship with TD Ameritrade, to expand our list of qualified custodians.

So please, contact us.

We find that many investment companies including some of the biggest names in the business don’t actually have a safety net to protect your portfolio. This means that they let your investments fall in price indefinitely, under the claim that their “mandate is to manage stocks, not cash.”

At Moneygrow, we take a different approach to safety.

If and when we see a component of a investment portfolio fall past 8% loss in the present quarter, we’ll go on alert and consider a sale of that position. For example, we held Moderna (MRNA) into the dramatic rise of its value, which peaked at $497/share from our buy at around $307. When European countries blocked the use of its COVID vaccine, we sold.

Today’s market price is $25 per share. While it’s true short term capital gains were made and reportable to the IRS, based on today’s price, the loss in value would have been far larger than the capital gains tax on the sale. A safety net matters.

Watch out! Bonds get slammed in a Rising Rate Environment

If you think holding bonds automatically means “safety,” think again. They only hold their value in a steady interest rate environment. Yes, they gain value in a falling interest rate environment…

But bonds lose value in a rising rate environment. With the Federal Reserve getting hawkish, if you are holding bonds, balanced mutual funds, or life-cycle investments based on retirement age, you are vulnerable. There is a teeter-totter relationship between rising rates and bond values. When rates rise, existing bonds go down in price. Even very short term bonds are not giving positive returns now.

Hedging Against Inflation

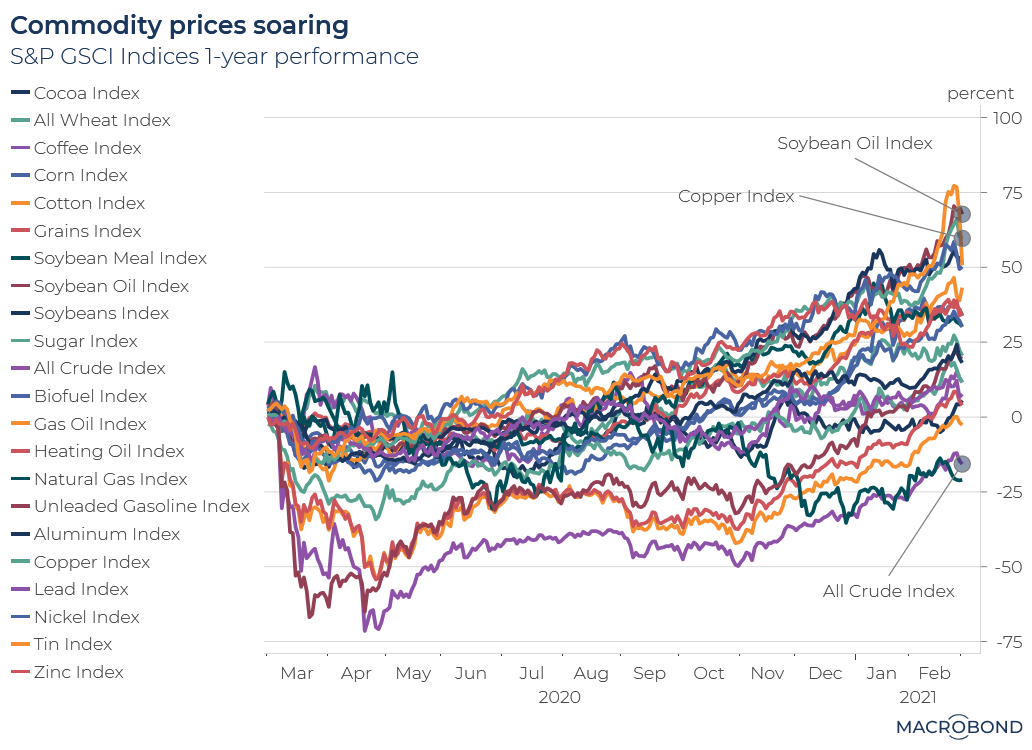

With annualized inflation rates approaching 8% (February 2022), your cash holdings are getting wiped out. What can we do about this? So far this year, just about the only investments that are making money are in energy and commodities of various types. Neither of these are low volatility but the trends for both are absolutely positive and we are reasonably confident that both classes have lots of upside. However, investing in either of these classes is a “don’t try this at home” exercise. The large assortment of investment vehicles out there that a do-it-yourselfer could buy to seek a hedge may be insufficiently diversified or not well managed, and this could easily and lead to unpleasant surprises.

Ask us and we’ll help you sort out this dilemma.

We’ve added Schwab as a Custodian

Do you have a retail Schwab or TD Ameritrade account and feel it’s time for you to get professional help from a Registered Investment Advisor, one that is required by law to do what’s right for you? Moneygrow provides a level of service that is far beyond what might get as a retail Schwab or TD Ameritrade customer.

For more that 35 years, Moneygrow has covered all aspects of Financial Planning and Investment management with the kind of personalized service that cannot be equaled by somebody working in a call center taking orders from retail investors. You deserve our dedicated, professional attention. We have recently added Schwab Advisor Services as a custodian. The relationship is not new to us; we used them back in the 90s before we started holding account custody at TD Ameritrade Institutional.

Both of these organizations are separate from their retail divisions. They serve investment professionals and the clients of Registered Investment Advisor firms.