This contains my observations about todays’ news vs my pro investor’s viewpoint. We’ll cover Inflation, Ukraine, Corporate Strength and the dramatic Meta/Facebook spanking and proposed legislation that might disrupt the ROTH IRA.

Narrative Vs. Economics/Geopolitics FACTS: WIDELY Divergent!

We closely follow the news cycle and the underlying Economics/Geopolitics. Today, there is a huge divergence between the “Facts” as reported on the Econ side, vs. the Narrative, as reported by media. Today, we find evident examples of this divergence.

- Inflation, Federal Reserve (FED) & European Community Bank (ECB) & Corporate Earnings Impact

- Ukraine/Russia/Crimea

INFLATION & CORPORATE IMPACT

The bottom line: Media over-reaction and fear-mongering relative to the prospect of rising interest rates and inflation/supply chain constraint doesn’t mean market prices will decline or that Corporations will immanently suffer.

Here are the details:

The Narrative

The narrative expresses concern that inflation, at a rate not seen for 40 years, is going to somehow instantly put the brakes on the US economy, compressing stock prices. The snowball effect of this expression suggests that as the FED and ECB ultimately respond to inflation with rate hikes, the automatic results will be a market downturn. The recent brief -10% correction in US S&P500 valuation, followed by the current dramatic rebound has been shocking to many people, leading to emotional reactions and erratic investor conduct that has been accentuated by media clickbait and emotional triggers.

The Economics

It’s notable that the major players who have had huge impact on the market rise in the past two years are EXTREMELY flush with cash. Bloomberg reported on 1/31/22 that

“Many American corporations, especially the big ones, are in dazzling financial health.. S&P500 companies had about $2.4 trillion in cash and short-term securities o their balance sheets at the end of the third quarter of 2021, compared with $1.6 trillion at the same time in 2019. Google parent Alphabet alone had $142 billion going into it final quarter of 2021. Microsoft had $131 billion, Amazon had $179 billion.”

The same source states:

Corp debt is also surprisingly low. For S&P500 companies the ratio was barely above 1 a record low ranging from 1990. Ratio was 4.25 in 2007 and 3.88 in 1999. Balance sheets are robust.

It’s notable that this very brief market correction mostly preceeded earnings announcements for the quarter. Once earnings are announced we expect recovery and are invested under that forecast.

The FED

History (meaning: The Numbers) does not support what we view as a knee-jerk and sophomoric claim that markets automatically sell off instantly once the Fed raises rates. Remember, the even the most hawkish prediction of fed rate hikes at 5x in 2022, which we believe is highly improbable represents an increase of 1.25%, hardly a huge economic drag. What history shows, is that after the Great Recession, once the FED finally began to hike rates, the market ROSE by nearly 50% after numerous 0.25% hikes before the rate hikes eventually slowed market price momentum. Given the remarkably low corporate debt, we don’t see justification that rate hikes somehow will produce huge impact on balance sheets for some time to come.

UKRAINE/RUSSIA/CRIMEA

The bottom line: We don’t buy the narrative that the current confrontation is a leadup to war. We see this as a “flexing” exercise in political dominance and world opinion, largely as a consequence of US political and social polarization and internal conflict.

The Narrative

Surprise, Surprise! The US is currently awash with “wars and rumors of wars.” Media, even progressive NPR, is full of stories about an immanent Russian invasion, troop buildups, and ginning up abundant war stories. Doubtless we have seen this pattern since the 1960s. The US “defense” industry has much to gain by weaponizing parties in the throes of conflict. Never underestimate the power of this sector to influence public opinion. Reference Vietnam, Iraq, Afganistan. All of which were highly profitable, based on propaganda, and yielding horrific results.

The Situation on The Ground

The US drop-shipped $200 million in arms plus tons more, recently, to Ukraine, deployed military resources and thousands of troops. Meanwhile, Bloomberg reports on 1/21/22:

German Chancellor Olaf Scholz signaled reluctance to participate in any effort to arm Ukraine as the U.S. and its allies face the threat of Russian forces deployed along the Ukrainian border. “We have not supported the export of lethal weapons in recent years,” he said.

And the Ukrainians themselves don’t see war as a fait accompli. BuzzFeed reports 1/24/2022:

KYIV – Ukrainians expressed confusion and anger Monday over Washington’s decision to authorize the voluntary departure of government employees from Kyiv and order the mandatory withdrawal of family members of US embassy personnel.

The Ukrainians, however, have been more cautious in their assessment of the situation, with current and former national security and defense officials saying they don’t recognize Russia’s latest military buildup as anything out of the ordinary.

Ukrainian President Volodymyr Zelensky “does not think there’s any remotely imminent threat to Kyiv” at the moment, a source close to the president told BuzzFeed News on Monday, reacting to the partial US withdrawal.

“The fact that the US was the first one to announce this” — this being the voluntary departures and mandatory withdrawals — “is extremely disappointing and quite frankly these Americans are safer in Kyiv than they are in Los Angeles … or any other crime-ridden city in the US,” said the source.

The source close to Zelensky said the president’s office viewed the US move as “utterly ridiculous” and symbolic of what it views as “US inconsistency.”

This is what we are seeing. You be the judge.

Crimea

Crimea

The Narrative:

Putin invaded Crimea and this is proof of his desire to re-establish the Soviet Union, and as such is a pre-cursor to invasion of Ukraine.

Relevant Facts:

In the Crimean Status Referendum of 2014, an overwhelming majority of the population with very small percentage of nonparticipating voters affirmed that they wanted to join the Russian Federation. While there is significant and ongoing political dispute about the validity of this referendum, consider the fact that a 60% majority of the Crimean population uses Russian as their native language.

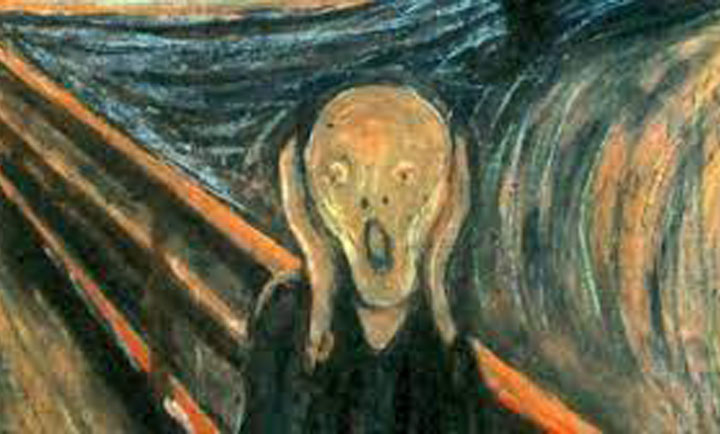

The point here is that the US has a widely-known and unambiguously-documented history of opportunistically fomenting war and conflict worldwide at a scale greater than any nation in history. As investors who seriously intend to foster a peaceful world, we cannot stand by and embrace conflict as a necessity or as a solution. We believe the outcome of this exercise teaches us that Foreign States view the horribly divisive US socio-political situation with an eye towards weakening US influence. They will flex muscle but not necessarily shed blood in the effort to demonstrate that US power has waned. The lesson for US politicians and the public is that rancor has detrimental worldwide impact and the longer it continues, the more likely a world-wide shifting of powers is consequent.

Meta/Facebook Gets Spanked Hard

It’s about Surveillance vs Privacy

META LOSES HUGE MONEY

The bottom line: Zuckerberg’s Meta got spanked HARD because Apple stopped them from spying on everybody who uses their apps on iPhone and iPad.

Yesterday 2/3/22 we witnessed a ~27% decline in Meta’s (Facebook) share price, wiping out a historic one fifth of the company’s market capitalization by over $200 BILLION. We all know the of Meta’s insatiable appetite for surveillance capitalism, not to mention the Cambridge Analytica debacle and Facebook’s worldwide failure to control false news exemplified by the genocide in Myanmar and the bizarre discorporate Virtual Reality push embodied (or disembodied) in the company’s new name. These all deliver every evidence that this company is the spawn of the devil.

Behind this story is a change by Apple in it’s iPhone Operating System iOS which essentially changed default privacy setting to “do not monitor my activities” from “it’s ok to monitor my activities.” So, any iPhone with Facebook, WhatsApp, or Instagram installed became inaccessible to Meta. Meta announced this blockage of it’s spying tentacles would cost it $10 BILLION in revenue. Plus Meta is investing huge money in developing software to drive the real world to live inside a fake world that requires use of its Oculus Virtual Reality headset. So earnings were constrained in a rarely seen change of trend.

We should point out that Oculus is defined as a “Round or circulate window.” But in the case of Meta, that window is not designed to give you perspective about reality, it’s designed to give you a view of fantasy, while it gives the prying eyes of Meta a clear picture of your reality so they can profile you and sell you stuff.

We are happy to see some investor-directed punishment here. We welcome this type of volatility. It ought to happen more often.

ASK US About ROTH IRA Contribution

Don’t miss the opportunity to open and contribute to ROTH IRA if you can for 2021. You need ordinary income to qualify for this contribution. It appears pending legislation could change the contribution rules for 2022+. Your contribution deadline is by tax filing date, typically April 15.

Your friends deserve to hear about the work we do!

Share this newsletter, and ask how we can help YOU!

Send us an

email or call with any questions or comments.

UKRAINE/RUSSIA/CRIMEA

UKRAINE/RUSSIA/CRIMEA

Crimea

Crimea