Recession Imminent? Nonsense!

Financial media just can’t get addicted enough to thoughtless prognostications. Recession forecasts are the Click-bait eyeball catcher du jour. Let’s break this down. And while we’re at it we’ll talk about inflation, inverted yield curve as a forecast for recession, what could deliver rising equity prices, how our portfolio is doing, and why despite the market decline this quarter WE DO NOT RECOMMEND SELLING OUT OF STOCKS.

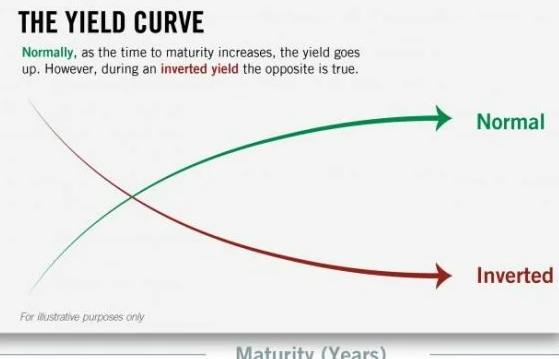

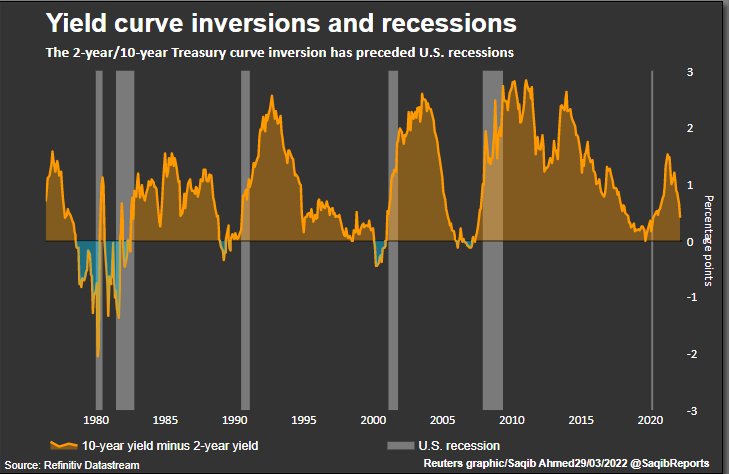

First of all, despite all the clamoring to catch your attention and feed media advertising coffers, THE YIELD CURVE IS NOT INVERTED. What are the facts? Current 10-year US Treasury securities are at 3.19% as of 5/11/22 yesterday. Source: https://home.treasury.gov/ Current 2-year US Treasury securities is 2.52%. Source: Bloomberg. The opposite would have to be true to show inversion.

NOT SO TODAY!

So, here we see a classic example of how financial media promulgates fear and anxiety even though the facts on the ground are not even close to confirming the narrative. For many market cycles we have noticed that when markets would sell off, the financial media would trot out pessimistic market BEARS and put them on camera. Then, when markets would rise, the financial media would trot out optimistic market BULLS and put them on camera. This could even shift from day to day. The game is rigged, folks. BEWARE.

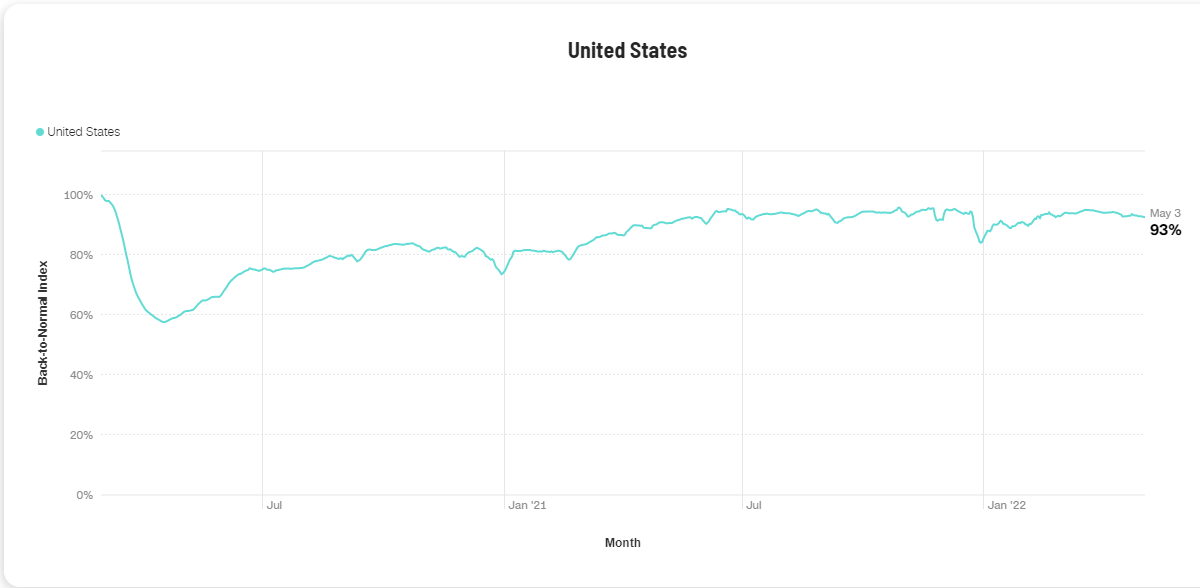

THE US ECONOMY IS STILL IN RECOVERY!

According to Moody’s analytics, the US economy was at 57% of its pre-pandemic economic condition in April of 2020, at the peak of lockdowns. Today, the US economy is at 93% of it’s pre-pandemic level. The economy is running within 3% of its all time high since pandemic inception EVEN CONSIDERING THE UKRAINE WAR EFFECT. The huge influx of cash from the Federal Reserve remaining in the economy, combined with the simple fact that many companies are reporting decent earnings continues to bolster the economy. This mountain of stimulus cash is the CAUSE of inflation. It will take some YEARS for rising interest rates to cool down inflationary trends. IF we get a recession, it could be years off. It is not “just around the corner.”

AND… WHAT COULD DRIVE MARKETS HIGHER?

Consider these factors: When investors sober up and realize that the yield curve is actually NOT forecasting recession, we could easily see a return to the appetite for stocks, boosting prices. And, another factor that could boost prices would be that the Russians limit their attacks to Ukraine and do not bring NATO into the mix, starting World War III. This is certainly within the realm of possibility. The Russians are not having an easy time of it in Ukraine and we don’t imagine they want to take on the whole of western Europe. If it proves accurate, the emotional and economic relief would bring a tailwind to stock prices.

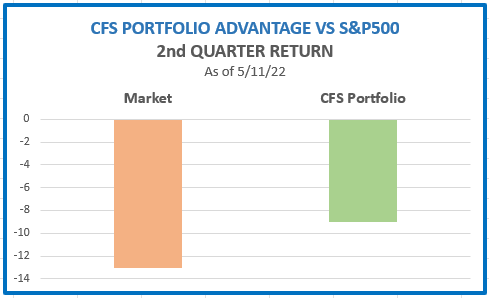

Explaining Our Investment Returns So Far This Quarter

It has made a big difference that we have chosen to be invested with refined exposure to inflation-fighting choices in the portfolio along with very on-trend positions in key companies and economic sectors. While we do maintain a vigilant “on alert” watchfulness and even hold a level of cash because market losses are a factor this quarter, our nearly 4 % advantage vs. the market speaks for the importance of choosing wisely. Also, as we have stated, we are not looking for an exit point based on CURRENTLY AVAILABLE DATA and CURRENTLY EVIDENT CONDITIONS. It is our perspective that despite the fact that markets are more fairly valued than they have been in years, there is a reasonable expectation that should we rise from today’s levels, if we were “out of the market” we would miss a key opportunity. And THAT is not an outcome we desire.