If your face was on a billboard showing the impact of your investments…

Would you be proud or embarrassed?

We take a diligent and watchful approach, with an eye on nearly 50,000 publicly traded investments. Performance is considered along with economic and market conditions. This helps us achieve a suitable balance between risk and opportunity.

This approach is even more effective when regulated by a moral compass that points towards investments in the future we want to bring about in our world.

Our Investment Philosophy:

As direct money managers we have developed advanced systems to reach such objectives.

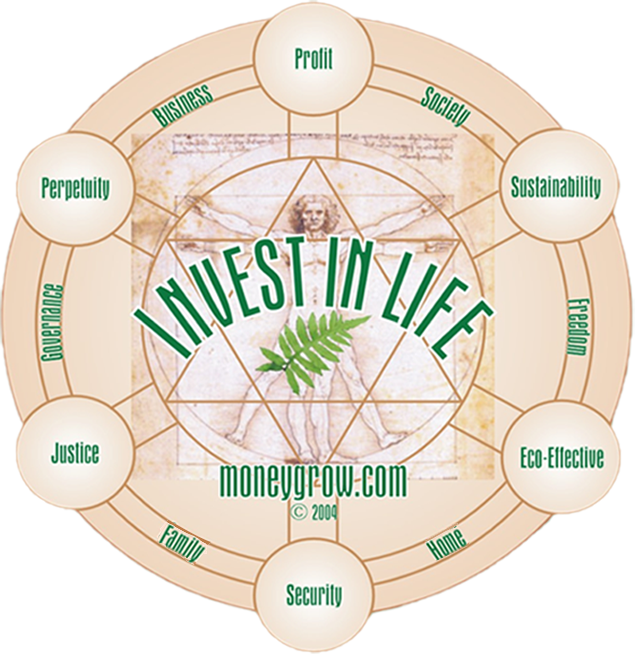

Blind pursuit of short-term profit alone can defeat wealth itself. The necessary balance that has been ignored by investors has led to instability and dangerous outcomes. Frederick Ravid developed the “Invest in Life” approach to show that each element requires its opposite to work correctly.

- Profit is effective only when the priority is long-term security.

- Justice is only legitimate when it’s lasting and sustainable.

- Perpetual business is only actually beneficial when it’s righteously eco-effective.

- Ultimately if the balance between Business-Home-Society-Family and Governance-Freedom are lacking, we wind up facing chaos, inequity, and destruction. That’s pointless.